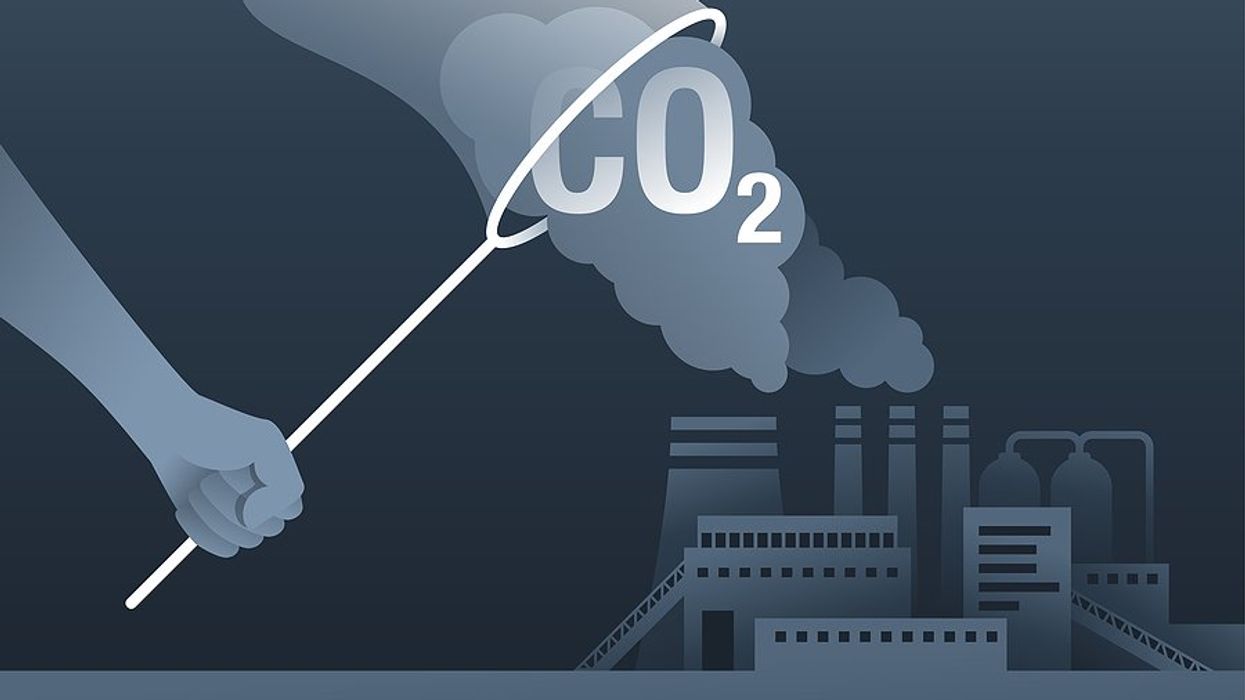

Banks have issued billions in "sustainability-linked loans" to polluting companies, but critics argue that the loans lack transparency and fail to ensure meaningful environmental improvements.

Sasha Chavkin reports for The Examination.

In short:

- Major banks have issued over $286 billion in discounted loans since 2018 to industries linked to deforestation and fossil fuels.

- Companies often report "emissions intensity" improvements instead of reducing overall emissions, allowing their total pollution to grow.

- Critics argue the loans enable greenwashing, with minimal oversight and few binding commitments to sustainability.

Key quote:

“It’s hard to breathe. I don’t know what’s going on, but there’s something in this air.”

— Carmella Causey, resident of Gloster, Miss.

Why this matters:

These loans can mislead the public about companies' environmental impacts, diverting funds from more sustainable projects and undermining efforts to reduce global carbon emissions. Communities near polluting operations also face health risks as companies expand harmful activities under a "green" label.

Related coverage: